+86 183 6377 3366

+86 183 6377 3366 News Categories

Featured News

0102030405

Global packaging glass bottle industry: moving towards new growth in green innovation and restructuring

2025-10-13

The global packaging Glass bottle industry stands at the dual crossroads of transformation and growth in 2025, with its market scale expected to exceed $180 billion. Driven by demand in core sectors such as food and beverage, pharmaceuticals, and cosmetics, it exhibits distinct characteristics of technological upgrading and regional differentiation. China, as a core industrial force, continues to lead with a 38.5% global share, while the green standards of European and American markets and the growth potential of emerging markets jointly shape the new global industrial pattern.

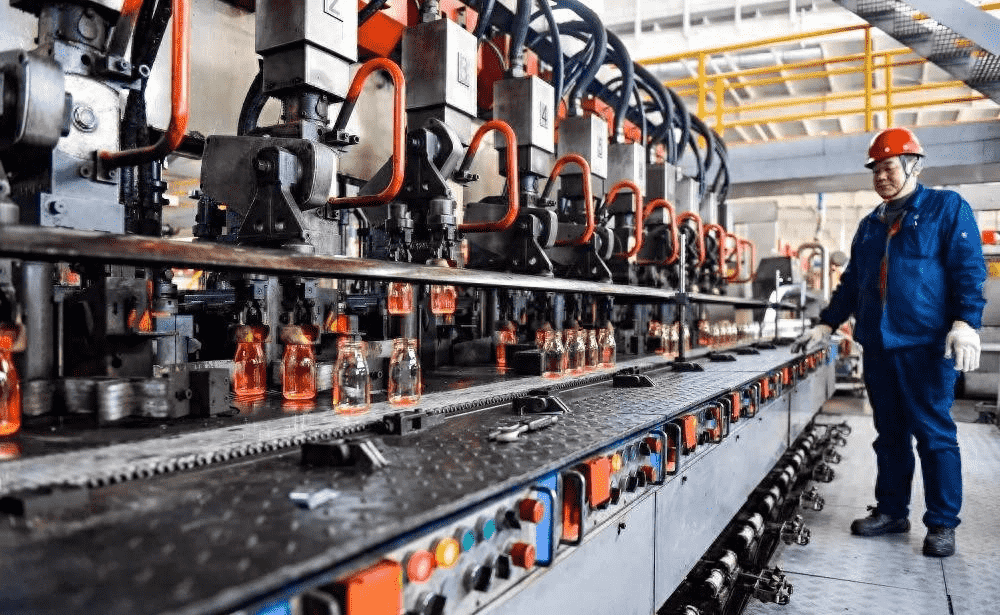

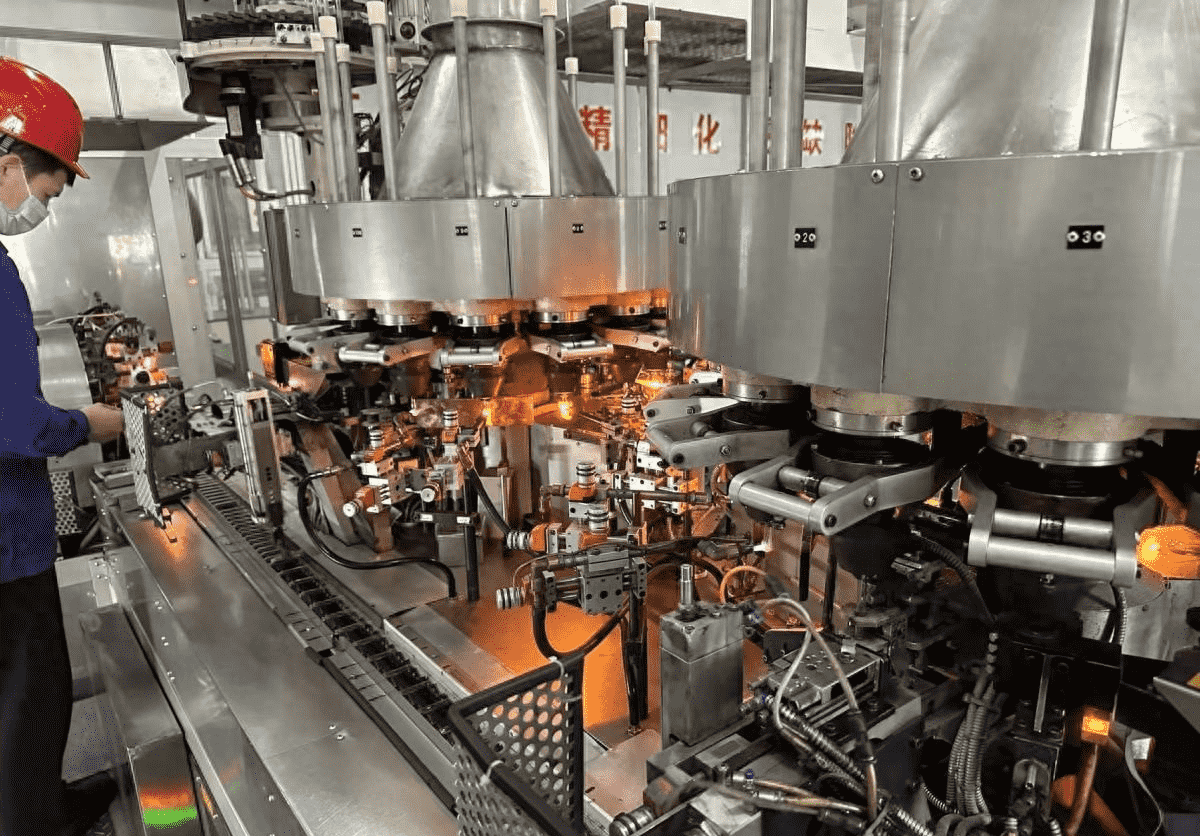

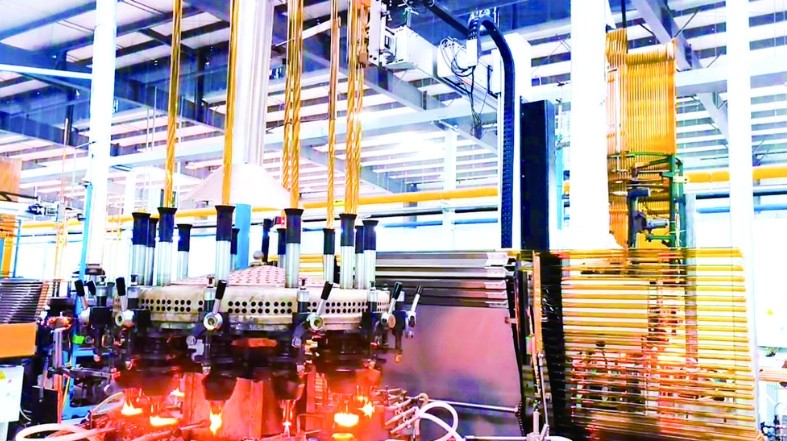

Technological innovation has become the core engine of industrial upgrading, with significant breakthroughs in both lightweighting and intelligentization. Currently, the average weight of glass bottles worldwide has decreased by 12% compared to 2020. The technical solution for transforming 330ml beer bottles from the traditional 220g to 180g lightweight versions has entered the commercial verification stage, and it is expected to save 1.2-1.5 billion US dollars in raw material costs by 2030. The in-depth penetration of intelligent manufacturing has reshaped production logic: the penetration rate of full-oxygen combustion technology exceeds 65%, reducing energy consumption by 20-30% and nitrogen oxide emissions by more than 80% compared with traditional processes; the new generation of bottle-making machines equipped with machine vision inspection systems has increased product qualification rate to over 98.5%, reducing the number of workers required for one production line from 20 to 8. Technological breakthroughs in the pharmaceutical packaging field are particularly crucial. As the core packaging material for vaccines and biological agents, neutral borosilicate glass sees a 9.7% annual growth in demand. Chinese enterprises are accelerating the process of domestic substitution, gradually reducing the 60% import dependence.

Policy-driven green transformation is reshaping industrial competition rules. The EU has set a 90% recycling rate target for 2030 with its "Green Deal", and its recycled glass utilization rate has reached 52%, with product carbon footprint decreasing by 40% compared to 2015; China's newly revised Extended Producer Responsibility system also locks the glass product recycling rate target at 90%, promoting the proportion of recycled glass from 20-30% to 40-50%. The commercial application of low-carbon technologies has achieved remarkable results: the installation rate of waste heat recovery systems in large enterprises reaches 85%, which can recover 30-40 kWh of electricity per ton of glass liquid; the combined process of SCR denitrification and bag dust removal controls particulate matter emissions below 10 mg/m³, far lower than international standards. These measures not only respond to environmental protection requirements but also become an important path for enterprises to reduce costs and increase efficiency. For example, Chinese enterprises have reduced production line energy consumption by 18% through the implementation of coal-to-gas policies.

Regional markets show a diversified development trend, forming a pattern of "core leadership and emerging rise". China's North China and East China industrial clusters rely on complete industrial chains, with an output of 28 million tons in 2024, accounting for more than 35% of the world. Bases such as Shahe in Hebei and Zibo in Shandong have realized full-chain coverage from raw materials to deep processing, with annual export volume reaching 12 billion US dollars. The EU, centered on high-end manufacturing in Germany (Schott) and France, accounts for 38% of the global high-end medical and optical glass market, but energy cost pressures have led to a 12% increase in industrial relocation in the past three years. Enterprises such as Corning in the United States focus on high-value-added fields, with R&D investment accounting for over 8% and patent quantity accounting for 32% of global high-end glass patents. Emerging markets such as India and Southeast Asia have become new growth poles with an annual growth rate of over 8%, undertaking industrial transfer with labor cost advantages. It is expected that India will surpass Germany to become the world's third-largest producer in 2027.

In terms of competition pattern, industrial concentration continues to increase, and the market share of the world's top five enterprises is expected to rise from 38% in 2023 to 45% in 2030. Enterprise strategies show obvious differentiation: leading enterprises accelerate the layout of the entire industrial chain, covering raw material procurement, intelligent manufacturing, and recycling; small and medium-sized enterprises focus on niche segments, creating differentiated advantages in fields such as special-shaped cosmetic bottles and high-end Wine packaging. Despite challenges such as energy price fluctuations and PET substitution, supported by ESG investment trends and breakthroughs in functional glass R&D, the industry will still maintain an annual growth rate of 4.5%, achieving high-quality development in circular economy and technological innovation.